Home > Blog > Artificial Intelligence

Subscribe to Our Blog

Get the latest trends, solutions, and insights into the event-driven future every week.

Thanks for subscribing.

We’re standing at an inflection point in the adoption of AI. What began as experimental conversations with chatbots is rapidly evolving into something far more profound: the integration of AI into the core processes that run our businesses and society. This shift from interactive AI to automated AI represents more than just a technological upgrade—it’s a fundamental change in how we work, and it demands an equally fundamental rethinking of the infrastructure that powers it.

Consider a major Middle Eastern bank that came to Solace facing an overwhelming surge in customer requests during a regional economic transition. Customer feedback forms on their website were flooded with inquiries about loan modifications, account transfers, and investment guidance, and their email support system was inundated with thousands of messages a day. Response times stretched to days, customer satisfaction plummeted, and support staff struggled to access the scattered information they needed to effectively respond to complex inquiries.

To see how Solace Agent Mesh aims to address the problem, check out this video:

The Trust Gradient: From Curiosity to Dependence

The bank’s journey with AI began cautiously –they deployed simple chatbots to handle basic account balance inquiries and branch location requests. These interactions were safe, predictable, and easily monitored. If the AI provided incorrect information, representatives could quickly intervene and correct the response.

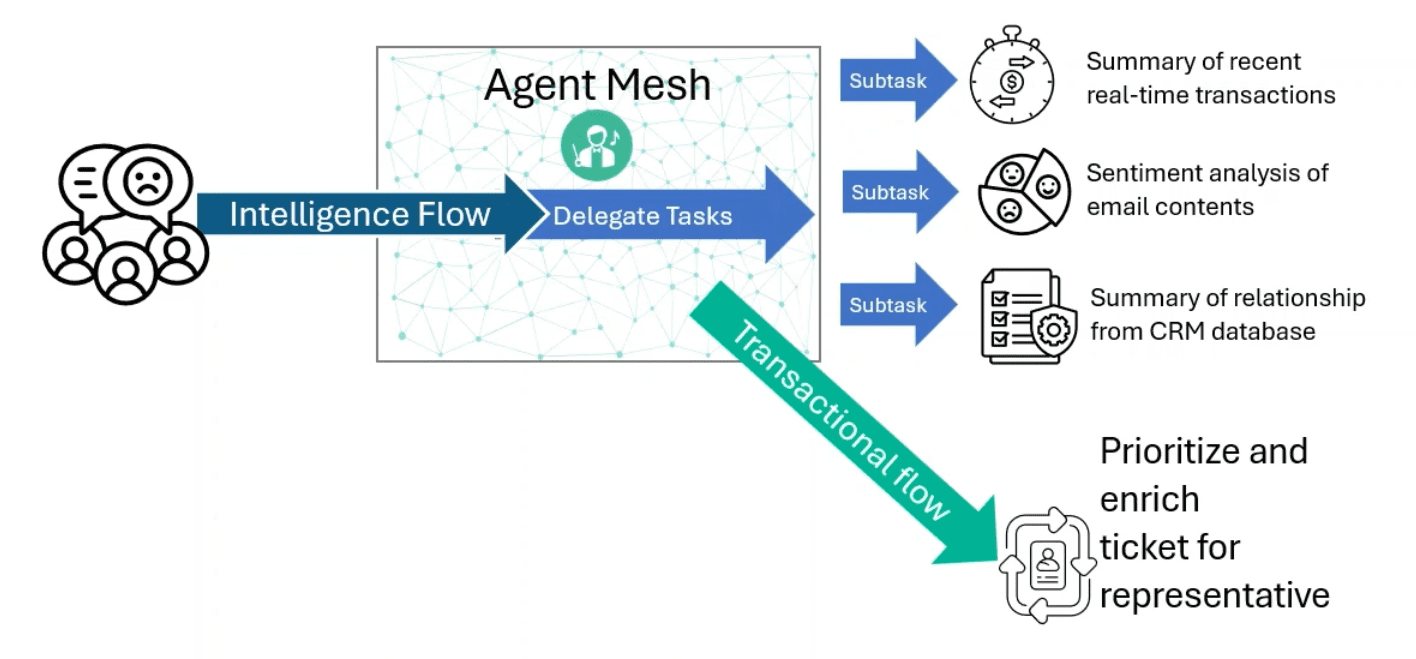

As confidence grew, the bank expanded their use of AI. They began using AI agents to help customer service staff process email inquiries by analyzing customer histories from CRM systems and identifying patterns in recent transactions. Instead of manually searching through multiple systems, staff was able to focus on the customer while AI processed and synthesized contextual information in the background. The human remained in control of customer communications, but AI supercharged their ability to understand customer situations and respond to their needs.

The Infrastructure Reality Check

Here’s where the comfortable world of basic AI chatbots revealed the true complexity of banking operations. When AI was just answering simple balance inquiries, occasional delays or temporary unavailability were minor inconveniences that customers could work around.

But as the bank’s AI agents evolved to support customer service across channels, the infrastructure demands became critical in new ways. The challenge wasn’t just speed—AI processing inherently takes time, and that’s acceptable when the result is thorough analysis. The real challenges were reliability, resilience, and coordination across the complex banking ecosystem.

When a customer submitted a feedback form or sent an email inquiry that triggered AI analysis of their complete financial relationship, that processing might take several seconds or even minutes to properly analyze years of transaction data, cross-reference multiple systems, and generate comprehensive insights. The infrastructure needed to handle these long-running processes gracefully, ensuring they completed successfully even if individual systems experienced temporary issues.

The infrastructure requirements for this banking transformation proved fundamentally different from what the organization had built for their initial chatbot deployment. Their existing systems relied on traditional banking architecture—synchronous calls between systems that would fail completely if any component was unavailable, and there was no systematic way to manage complex, multi-step processes that might need human intervention at various stages.

But AI agents supporting customer inquiries don’t have the luxury of simple success-or-failure outcomes. When processing a complex loan application submitted through a web form or detailed email, the AI might need to gather data from a dozen different systems, wait for external credit checks, incorporate human risk assessments, and coordinate with multiple departments—all while maintaining the ability to pause, resume, or redirect the process based on changing circumstances or human input.

The New Foundation: Event-Driven Architecture

The future of AI automation demands event-driven, resilient infrastructure that can orchestrate complex, long-running processes across distributed systems. This isn’t about making things faster—at least not entirely or initially—it’s about making them more reliable, observable, and adaptable to the realities of both AI processing requirements and human oversight needs.

At the heart of this transformation is the need for enterprise-grade event brokers that can handle the complex orchestration requirements of banking AI workflows. While simple technologies like Server Sent Events (SSE) might suffice for basic web applications, they fall far short of what’s required for mission-critical financial operations. As noted in the Agent2Agent (A2A) Protocol documentation: “In enterprise or production settings, this is often a robust, secure service that handles incoming webhooks, authenticates callers, and routes messages (e.g., to a message queue, an internal API, a mobile push notification gateway, or another event-driven system).”

Event-driven architecture treats every piece of banking data and every step of AI processing as events in managed workflows orchestrated by enterprise-grade brokers. Instead of traditional synchronous calls between banking systems, platforms publish events to secure, authenticated brokers that trigger AI processing pipelines, which in turn generate events that can involve human reviewers, trigger additional processing, or update customer records.

Advantages of EDA in Banking AI

his approach provides several critical advantages for banking AI operations:

- Process Resilience: Enterprise event brokers guarantee delivery and persistence, so banking workflows can pause and resume without data loss—even during outages or extended AI processing. Unlike SSE, which drops connections on network issues, brokers durably store events and analysis steps, ensuring continuity.

- Authentication and Security: AI workflows in banking demand secure, authenticated messaging that SSE can’t offer. Enterprise brokers enforce caller authentication, encrypt messages in transit and at rest, and apply granular access controls—ensuring sensitive data reaches only authorized systems and teams.

- Complex Message Routing: Banking workflows often require routing based on content, risk, or regulation. Enterprise brokers support this by delivering AI insights to multiple destinations—updating records, alerting compliance, notifying staff, or assigning human reviews—all in parallel.

- Human-in-the-Loop Integration: When AI flags fraud or needs risk review, enterprise brokers route tasks to human experts based on rules like expertise and availability, wait for secure input, and resume processing—while maintaining a full audit trail of both human and AI decisions.

- Scalable Process Management: During spikes in demand, brokers handle thousands of AI tasks in parallel, each with guaranteed delivery and ordering. When breaking news drives customer activity, brokers prevent dropped or duplicated messages that could compromise data integrity.

Preparing for the Inevitable

The transition from interactive AI to automated AI isn’t a possibility—it’s an inevitability. Organizations that recognize this shift and begin building the necessary infrastructure foundation now will have a significant competitive advantage. Those that continue to rely on chatbot-era infrastructure will find themselves unable to capitalize on AI’s true potential for managing complex, multi-step processes.

The future belongs to banks and other enterprises that can move beyond having AI assist customer service staff to having AI orchestrate complex processes that seamlessly integrate automated analysis with human expertise where it’s most valuable. But that future requires infrastructure built for the sophisticated workflow demands of modern AI applications, not the simple request-response patterns of basic chatbots. The time to start building that foundation is now.

Agentic AI in Action:Why Real-Time Is Non-NegotiableOn-demand webinar featuring agentic AI case studies and expert analysis from Forrester.Watch the Webinar

Explore other posts from category: Artificial Intelligence

As an architect in Solace’s Office of the CTO, Jesse helps organizations of all kinds design integration systems that take advantage of event-driven architecture and microservices to deliver amazing performance, robustness, and scalability. Prior to his tenure with Solace, Jesse was an independent consultant who helped companies design application infrastructure and middleware systems around IBM products like MQ, WebSphere, DataPower Gateway, Application Connect Enterprise and Transformation Extender.

Jesse holds a BA from Hope College and a masters from the University of Michigan, and has achieved certification with both Boomi and Mulesoft technologies. When he’s not designing the fastest, most robust, most scalable enterprise computing systems in the world, Jesse enjoys playing hockey, skiing and swimming.

Subscribe to Our Blog

Get the latest trends, solutions, and insights into the event-driven future every week.

Thanks for subscribing.