If there’s one sure bet in online gambling, it is unstoppable global market growth. The US government has twice tried to stall this transition to virtual gaming, first in 2006 when they made it illegal for financial service companies to knowingly collect payments for online gambling, and again in 2011 when they seized the domain names of top poker sites and charged their executives with money laundering.

Surely hampering access to the world’s largest and most affluent market would slow down the pace of online gambling right?

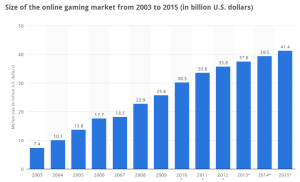

Wrong. Check out this chart from Statista:

You can see that the rate of growth did slow in 2007 and 2012 (projections in the 2012 case), but is hardly even noticeable in context of the long term trend. This is such an unstoppable freight train that the full might and power of the US government to block online gaming barely measures as a blip.

Now comes evidence that the US is gearing up to allow online gambling in the US after all. They have figured out what every country figured out a long time ago: people are going to gamble, online gambling makes it easy, and you might as well have the profits taxed in your country instead of a foreign country. You may also have seen recent news of non-traditional gambling entities like Zynga and Big Fish Games eyeing this market to get in on the growth. Expect the opening of the US market to spark a free-for-all of new market participants, gaming services and technology investment that will push growth rates even higher over the next few years.

At Solace, we have already been the beneficiaries of the massive growth in online gaming internationally — it is currently one of our fastest growing market segments. Several of the world’s largest online casinos and sports betting websites have chosen Solace for distribution of real time odds and in game event management. Many of these sites have traffic volumes to rival the largest stock exchanges and they need reliable and scalable infrastructure that protects them from the kinds of traffic spikes (poker tournaments, World Cup, Superbowl, etc.) that can stress software infrastructures resulting in sluggish performance or even outages. The companies best prepared to deliver a consistently high-quality user experience through high rates of customer acquisition and game play growth are the ones that will emerge as the winners in this market.

Explore other posts from category: Use Cases

Solace

Solace