I recently sat down with Navin Surya, a fintech industry expert who advises, invests in numerous startups, and serves as the chairman of the Fintech Convergence Council and National Payments Corporation of India (NPCI), to talk about how banks can benefit by modernizing their payment processing systems and architecture. We talked about the impact of regulations, how the pandemic accelerated digitization of financial services, and more, and discussed some real-world success stories that he’s familiar with. You can watch the webcast here, but I wanted to document some of the key questions we considered, and insights he shared, as a blog post.

What’s Driving Change in the Payments Industry

There are a handful of developments that are driving change in the industry, namely:

- Self-regulatory organizations (SROs)

- Initiatives like the new ISO 20022 standards framework for payments

- Cryptocurrency

- Digital currency issued by central banks

- The acceptance infrastructure development fund

The single biggest shift, however, is the move to digital payments. A decade ago, just 5-6% of consumers were actively using digital payments and today we’re at about 18%. However, soon that figure will be 100% and to meet that quickly approaching reality, there needs to be new energy, new thought processes, new ideas, and new technologies.

A side effect of digital payments is increasing volumes — it’s just so easy to buy things now. In India alone there’s about a billion transactions a day, many of them mini or micro transactions of single digit dollars or less. Factor in the pandemic pivot to online ecommerce and digital payments are here to stay. Whether it’s the network, the banks, the point of sales system providers, the entire ecosystem, everything is scaling up and almost looking like high frequency trading.

Then there is the scope of change, and figuring out who needs to change what in order to meet these new requirements. If you look two decades back when there were no regulations, there was only a credit card as a payment transaction available on the system. The transaction failure rates in the early days of digital payments was as high as 20%. Today you’re talking about 3%, and in some cases as low as 1%. Better, but still a challenge and area where improvement is needed. Analytics and customer behavior analysis are important aspects to consider in a system.

White Paper: Enabling Modern Digital Retail Banking with Event-Driven ArchitectureLearn how retail banks can benefit from event-driven architecture (EDA) and what you need to know about selecting a platform to support your EDA adoption.

While there are a lot of solutions being developed, there’s no universally accepted practice yet. One challenge is that legacy systems are still in play, and batch-based and file-oriented information sharing is a big component. The shift to web services, APIs, and event-driven architecture is underway, but it doesn’t happen overnight. APIs, for example, make a great entry point for north-south traffic, but leading players are paralyzed by the number of events (payment handling, credit checks, fraud detection, etc.).

How EDA Enables Next-Gen Payment Processing

A payment system is essentially a messaging system; initiation of payment, a validation, a clearing settlement, loyalty-related stuff – all of these are events, i.e. messages, that go from one system to the other. Solace started out mainly with customers in the capital markets and investment banking space, so our technology is very good at this.

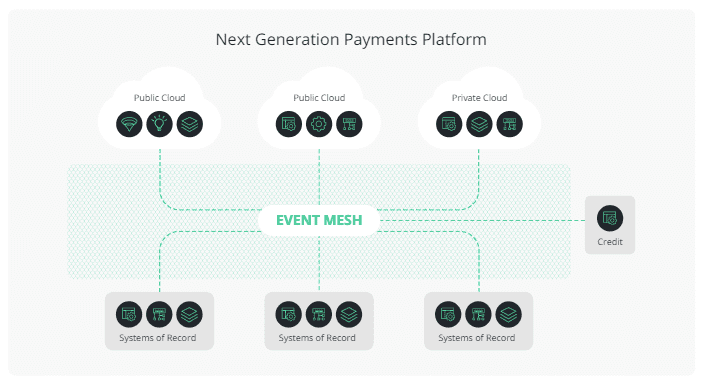

The financial services and payment processing sectors are entering a phase of complete distribution. Some of these systems could be in the cloud and some could be on-premises. We believe the future of digital transformation in the electronic payment processing space is paved with an event mesh – an architecture layer that allows events from one application to be dynamically routed and received by any other application no matter where these applications are deployed (no cloud, private cloud, public cloud).

Fig 1. Next Generation Payments Platforms will be Connected by a Real-Time Data Streaming and Tracking Event Mesh

So if you’re think of modernizing a payment processing platform, follow these three steps:

- Build and event-driven foundation underneath – a distributed network of messaging or event brokers

- Put a governance framework in place

- Ensure there is a method to catalog of all of your events so you can understand and repurpose events and flows

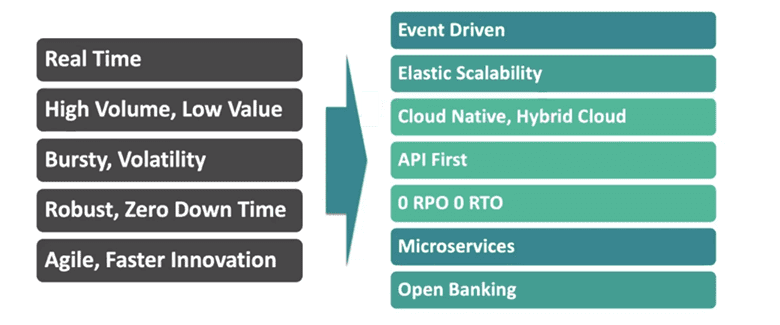

To support real-time electronic payments, with very high volume, low value transactions, bursty and volatile traffic, and zero downtime, you’ve got to start thinking event-driven. You’ve got to prioritize elasticity, scalability, robustness, and building better customer experiences.

Fig 2. The Technical Imperatives to Supporting Real-Time Electronic Payments

Modernizing Electronic Payment Processing Architecture with Microservices

Until about 2010 disc was faster than the network, right? That’s why we used to carry our music on CDs or USB drives. But now we stream our music because, for the past five years, network has actually overtaken disc in its speed and its bandwidth. So how do we modernize this payments architecture, which was very disc based?

One way is to break it down as microservices and distribute them, so you’re not writing to the database anymore. This way you get better modularity, better innovation. Having said that, when you take all of the slower steps in line, the FX, the clearing, the settlement, they can slow you down. So what you do is you take the steps that do not have to be in line (synchronous) and make them asynchronous. That’s how you get speed. That’s how you get more throughput, better response, time, better customer experience.

Enabling Payments Modernization with an Event MeshLearn how big players in the payments ecosystem are modernizing their infrastructure to support high volumes and real-time transactions while integrating with legacy systems and new technology.

Explore other posts from category: Use Cases

Sumeet Puri

Sumeet Puri