Home > Blog > Industry Solutions > Financial Services

Citigroup is one of the world’s largest financial institutions, operating across a vast and complex FX trading ecosystem. Every day, their systems handle tens of billions of messages across 12 global locations, all in support of one of the most dynamic and fast-moving markets in finance. So how do they keep that massive infrastructure running with low latency, high resiliency, and real-time responsiveness?

This post summarizes a talk delivered by Gregory Foden, FX Infrastructure Lead at Citigroup, at EDA Summit 2024.

You can watch the full presentation below or at EDASummit.com.

Why Event-Driven Architecture Matters so Much in FX

The foreign exchange (FX) market is a unique beast. It’s not centralized like a stock exchange—it’s a 24/5 over-the-counter market where banks, investors, and institutions trade directly, often through electronic communication networks (ECNs). In fact, the Bank for International Settlements reports that over $7.5 trillion is traded in FX daily.

Citigroup acts as a market maker in this space, meaning they provide liquidity, set prices, and facilitate high-speed trading with incredibly tight timing requirements.

And that’s exactly where event-driven architecture (EDA) plays a key role.

The Evolution of Messaging in FX Trading

As Gregory explains, the FX business has long used messaging systems for market data, orders, quotes, and risk updates. These are small, high-frequency messages that need to be distributed in real time to dozens—if not hundreds—of systems and users across the globe. These messages stream continuously throughout the week and often spike dramatically during major market events like Fed announcements or jobs reports. They must reach consumers with predictable low latency and support high fan-out distribution from a single publisher to hundreds of consumers. Most messages are compact—often just a few hundred bytes—yet critical for real-time decision-making.

Subscribe to Our Blog

Get the latest trends, solutions, and insights into the event-driven future every week.

Thanks for subscribing.

Citigroup has embraced these patterns for years, relying on a publish-subscribe messaging model to ensure real-time updates are shared instantly and reliably, regardless of the number of consumers.

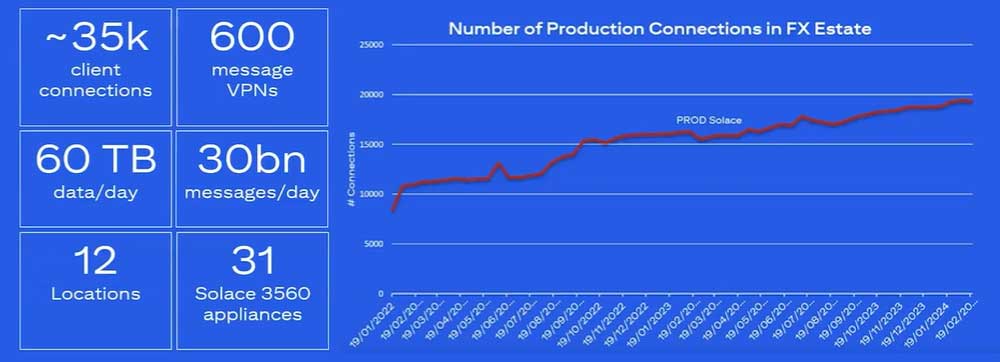

Building a Global Event Mesh

Back in 2013, Citigroup selected Solace Platform as their strategic messaging middleware. Today, their FX trading infrastructure spans an impressive 31 hardware brokers deployed across 12 locations. These brokers process over 30 billion messages and 60 terabytes of data per day, supporting a complex network of both local and wide area flows. Some of these flows require sub-millisecond latency, while others are optimized for global data distribution across high-performance WAN links. He showcased some of the key stats, and the steadily climbing number of production connections to Solace brokers in their FX estate.

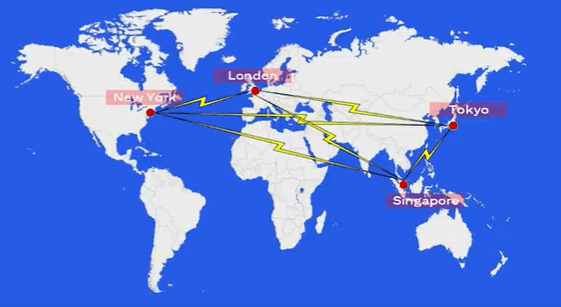

Citigroup built their event mesh using Solace Platform’s multi-node routing capabilities and VPN bridges, layered over their finely-tuned WAN topology. This architecture enables optimized routing of traffic across their global hubs while maintaining low-latency operations and ensuring performance predictability. It also provides built-in operational intelligence: WAN performance can now be monitored in real time using TCP-level metrics exposed through Solace APIs, dramatically improving collaboration between infrastructure and support teams.

Benefits of EDA at Citigroup

By adopting event-driven architecture, Citigroup has built a more stable, scalable, and intelligent FX trading platform. The move to an event mesh has improved system performance, reduced complexity, and enabled real-time data distribution across global trading hubs. Key benefits include:

- System stability and uptime – EDA ensures continuous 24/5 FX trading with no intra-week downtime. Even during major market events, latency remains predictable, preventing disruptions as trade volumes surge 10x to 20x within seconds.

- Unified messaging infrastructure – Previously relying on multiple middleware platforms, Citigroup consolidated messaging into a single infrastructure, supporting both low-latency and guaranteed messaging, reducing complexity, and streamlining global FX trading operations.

- Seamless system integration – EDA enables real-time data flow between front-office, post-trade, and UI systems, allowing traders, risk managers, and regulatory platforms to receive and react to trade events instantly, improving decision-making and compliance.

- Scalability for high-volume trading – With 30 billion messages processed daily, Citigroup’s publish-subscribe model efficiently distributes high-frequency market data to hundreds of subscribers without performance degradation, even at peak trading hours.

- Advanced WAN monitoring – Solace’s event mesh optimizes WAN performance across global trading hubs, providing real-time TCP-level monitoring to proactively detect network degradation and accelerate troubleshooting, reducing operational overhead.

- Operational flexibility and future-proofing – EDA supports hybrid cloud integration, allowing seamless scaling, upgrades, and new broker deployments without disrupting trading operations—ensuring Citigroup remains adaptive to evolving regulatory and market demands.

By unifying messaging, improving system visibility, and enabling real-time responsiveness, Citigroup has created an FX trading infrastructure that is not only resilient today but also ready for future innovations.

Looking Ahead: Hybrid and Cloud Expansion

Looking ahead, Citigroup is pursuing several strategic enhancements to their architecture. They’re expanding their use of software brokers in development and UAT environments, which will allow teams to scale rapidly and experiment more freely. They’re also continuing to migrate off legacy distribution platforms to streamline operations further.

In parallel, the organization is adopting newer capabilities from Solace, including Solace Cache, partitioned queues, and message replay, which offer advanced options for performance and data flexibility. Their recent proof-of-concept with Solace Cloud has opened the door to hybrid deployments, where on-prem hardware brokers can be seamlessly integrated with cloud-based brokers for added agility and scalability.

Final Thoughts

Citigroup’s journey shows how even the most demanding, latency-sensitive systems can benefit from a well-architected EDA approach. Rather than reinventing the wheel, they’ve evolved their infrastructure using technologies and patterns that align with the needs of real-time, distributed trading.

For anyone navigating the challenges of modern system integration, their story is a powerful reminder: EDA isn’t just about chasing trends—it’s about building systems that are flexible, scalable, and built to last.

Explore other posts from category: Financial Services

Greg has been marketing middleware for most of his career, across a long tenure with Solace and TIBCO before that. He enjoys helping people understand the importance and impact of "event-driven" by crafting clear copy and compelling visuals that tell the tale.

Subscribe to Our Blog

Get the latest trends, solutions, and insights into the event-driven future every week.

Thanks for subscribing.