Objective

Using the Google Consumer Survey (GCS) tool, we surveyed consumers on their attitudes toward connected cars and their willingness to trust, use and advocate for this emerging technology.

Methodology

The survey polled U.S. online consumers who identified as connected car drivers. All results were weighed against the U.S. Census Bureau Current Population Survey for age or gender so as to be representative of the adult U.S. Internet population.

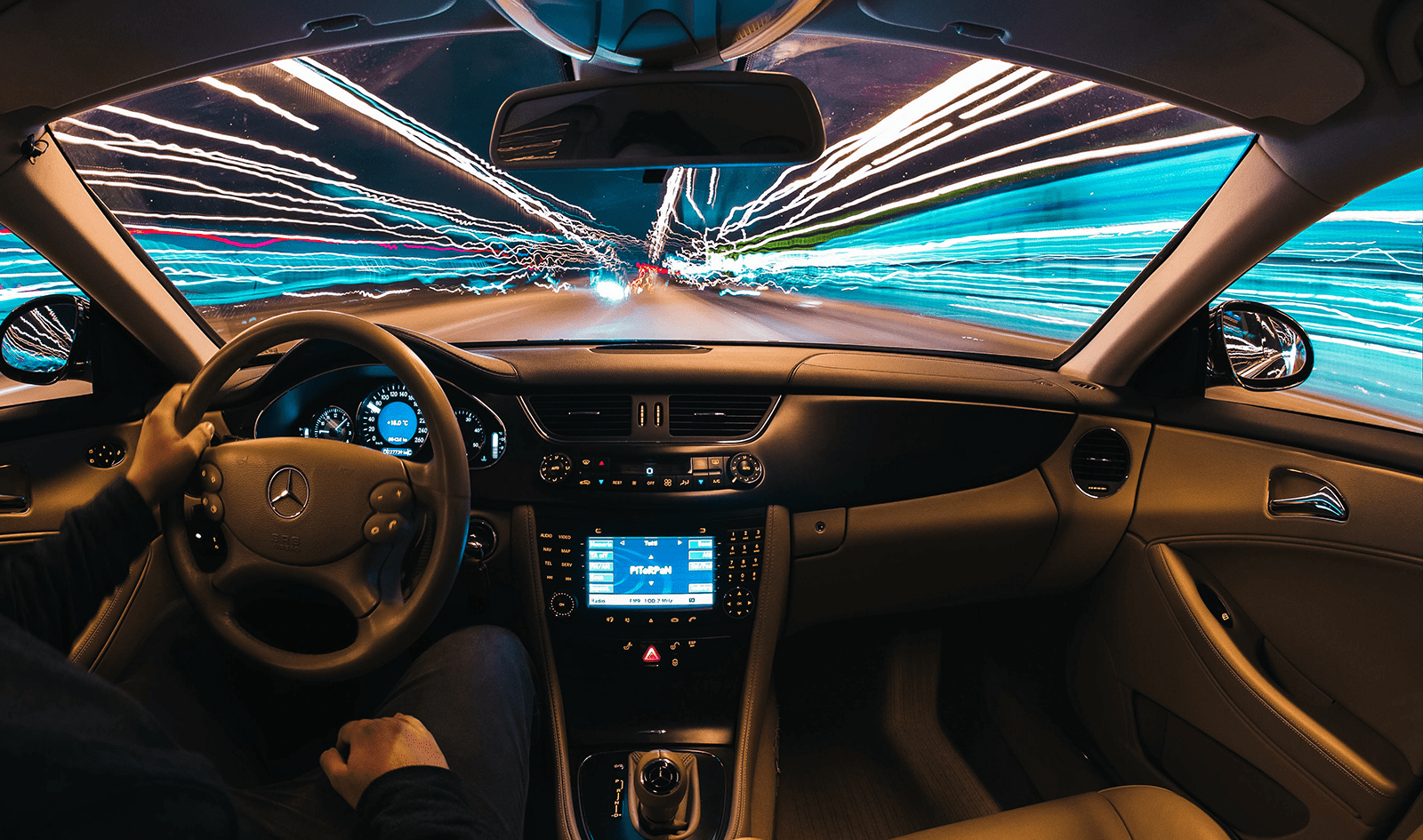

Overview

While consumers and, more specifically, connected car drivers, are open to incorporating new technology into their driving experience, they are not ready to hand over the wheel. Drivers today prefer technology that has an “influence” rather than a direct impact on their driving.

As automobile companies look to invest more in connected and autonomous vehicle technology, they will need to better understand how response times and performance of connected capabilities impacts consumer trust.

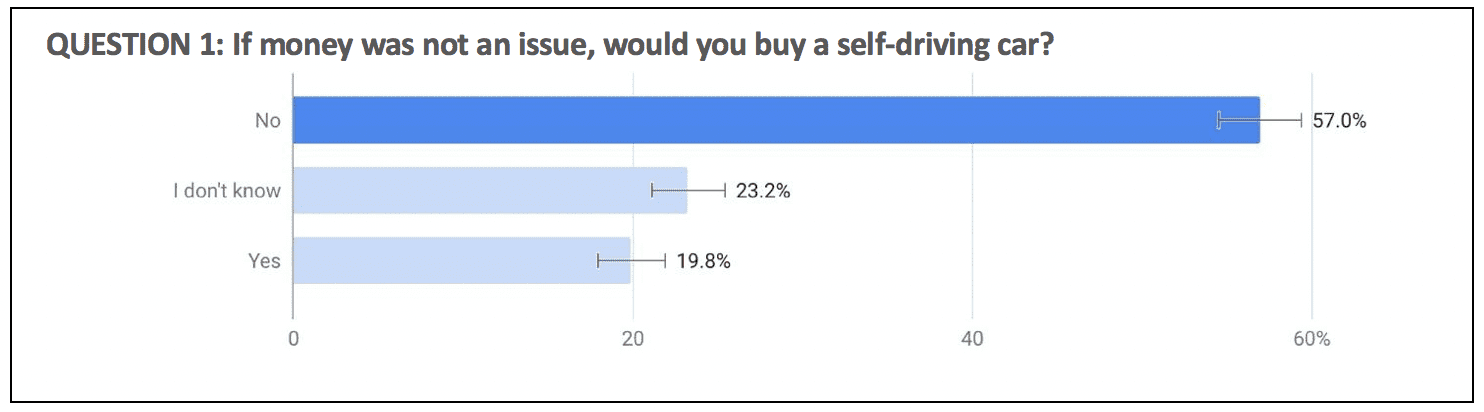

Most connected car drivers would not buy a self-driving car

Almost 60% of connected car drivers would not buy a self-driving car — even if cost weren’t an issue.

It’s long been assumed that cost would be a significant barrier to entry when self-driving cars enter the mass market. However, the results to our first question tipped the scale toward the other commonly-cited barrier: distrust in autonomous vehicle technology.

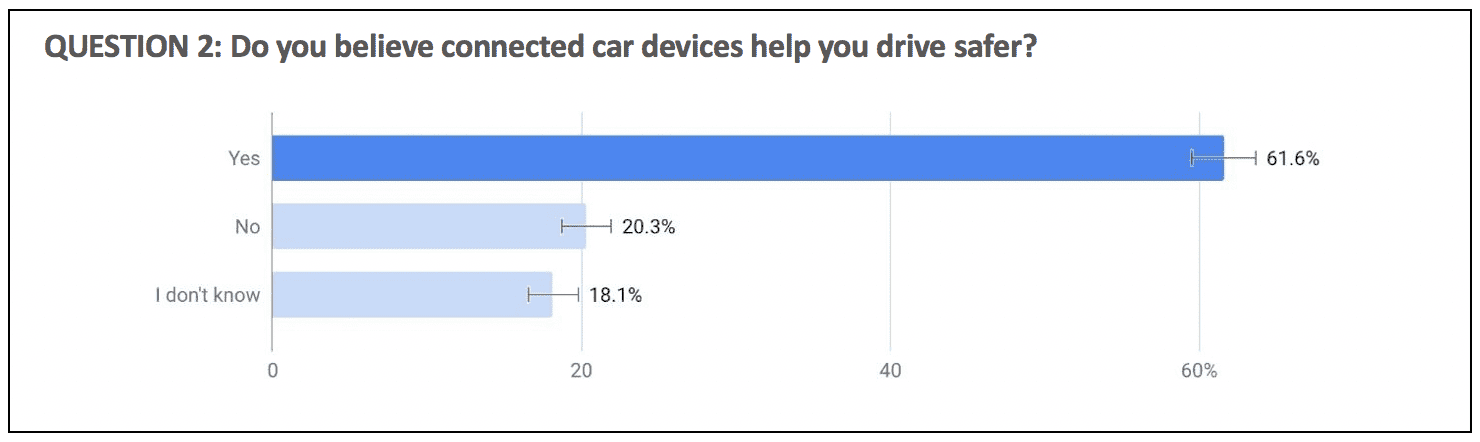

Consumers feel safer in connected cars, but don’t want to lose control of the driving experience

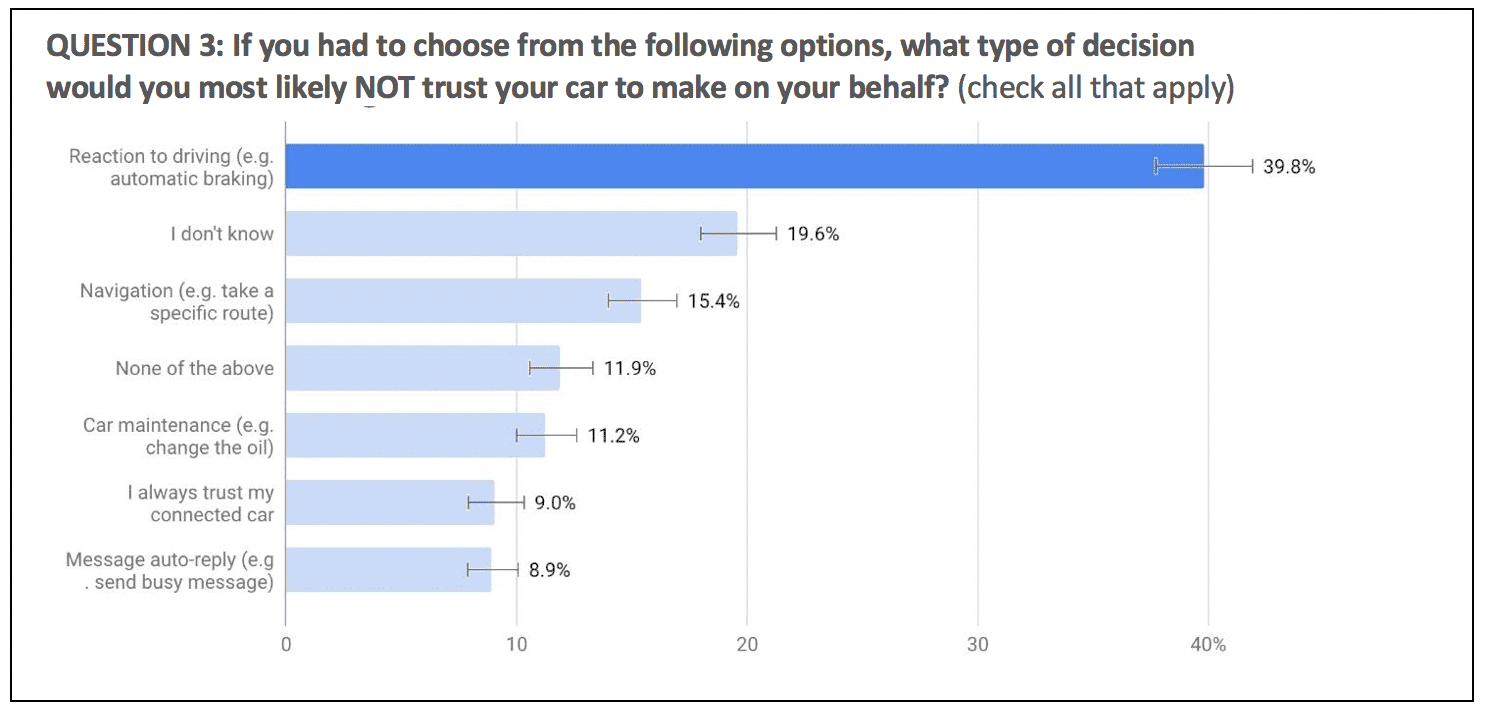

While almost two-thirds (62%) of connected car drivers believe their connected cars help them to drive safer, 40% of drivers won’t trust their car to brake for them. Additionally, when asked what actions they would not trust their car to make only nine percent of drivers noted they always trust their connected car.

The responses here shined a light on the connected capabilities that are widely adopted vs. the technologies capable of taking over key experiential elements of driving, such as braking.

To explore trust at a deeper level, we asked respondents which aspects of connected car decision-making they least trust:

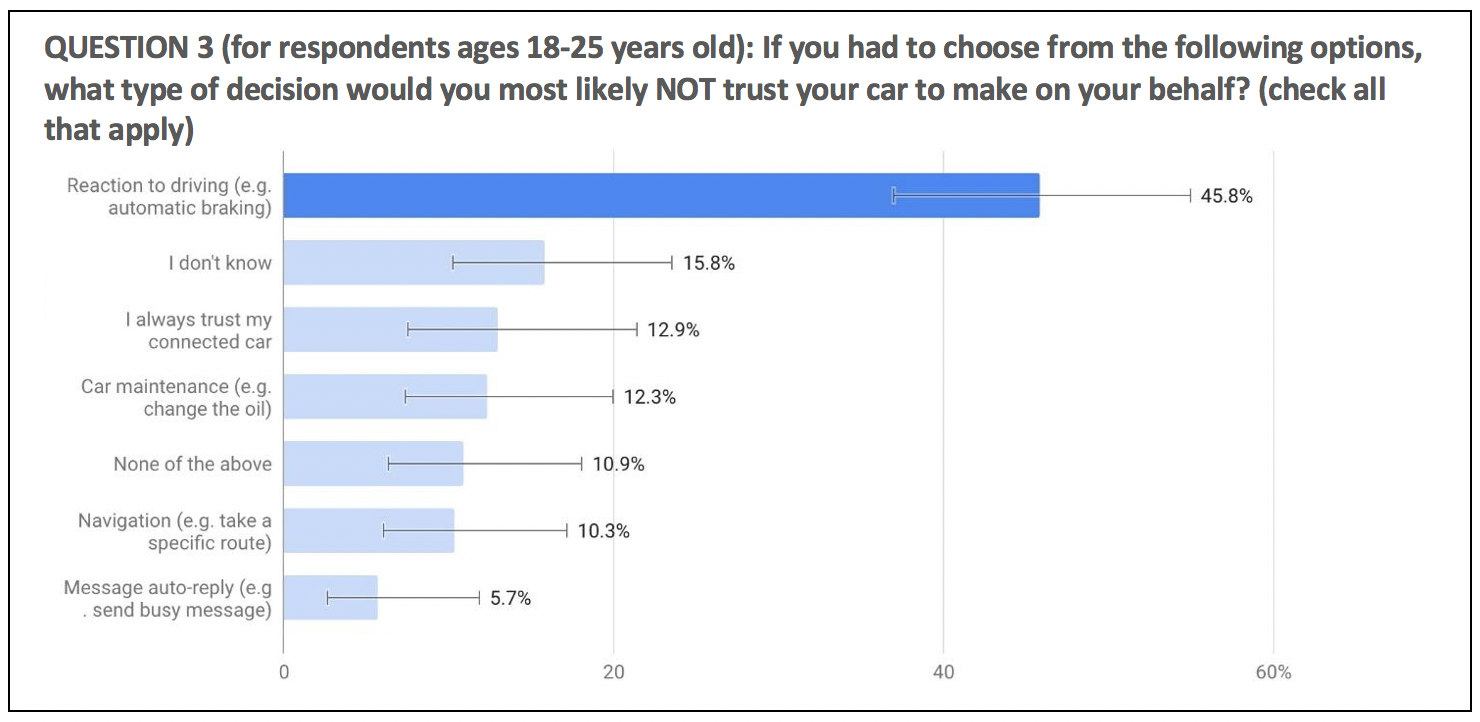

Among common connected car features, drivers are most reluctant to trust their car to automatically react to driving conditions for them. Counterintuitively, almost half (46%) of young millennials wouldn’t trust their car to automatically react to driving conditions, whereas only a third of drivers 65 or older felt that way.

The data collected here goes against both widespread belief and other research on related topics. Millennials are thought to be the most open to handing over the driving experience to technology, but the responses here tell a different story:

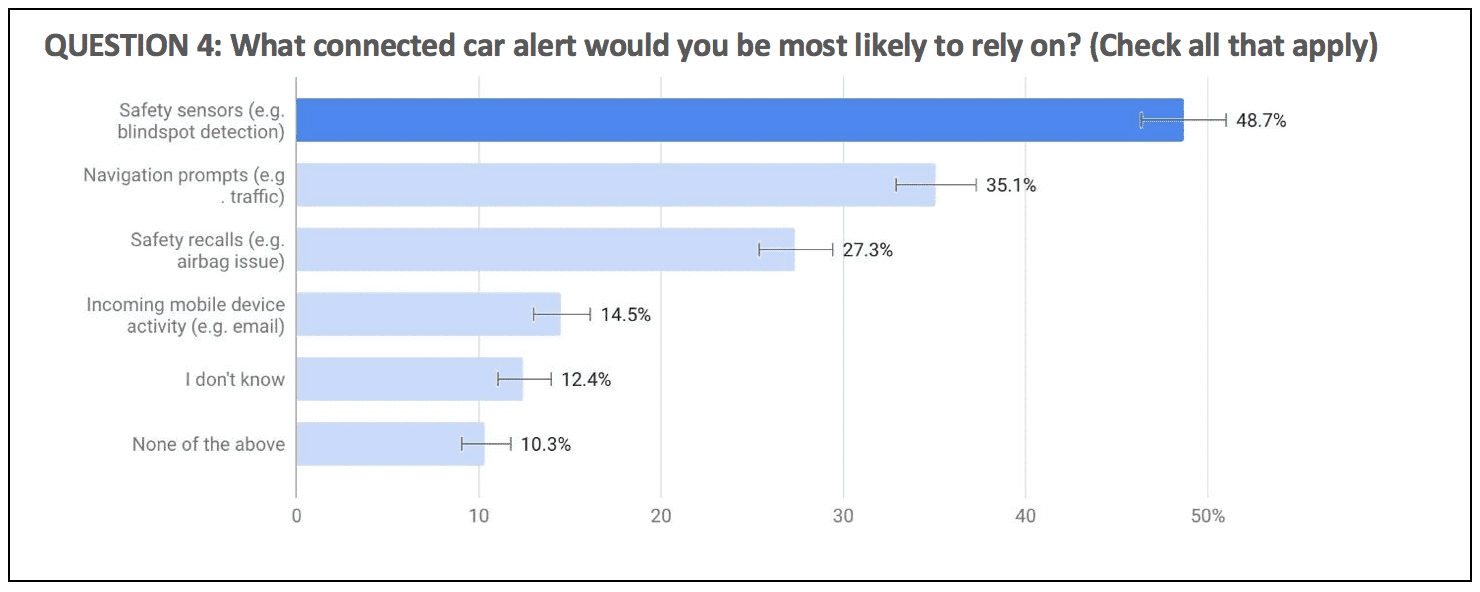

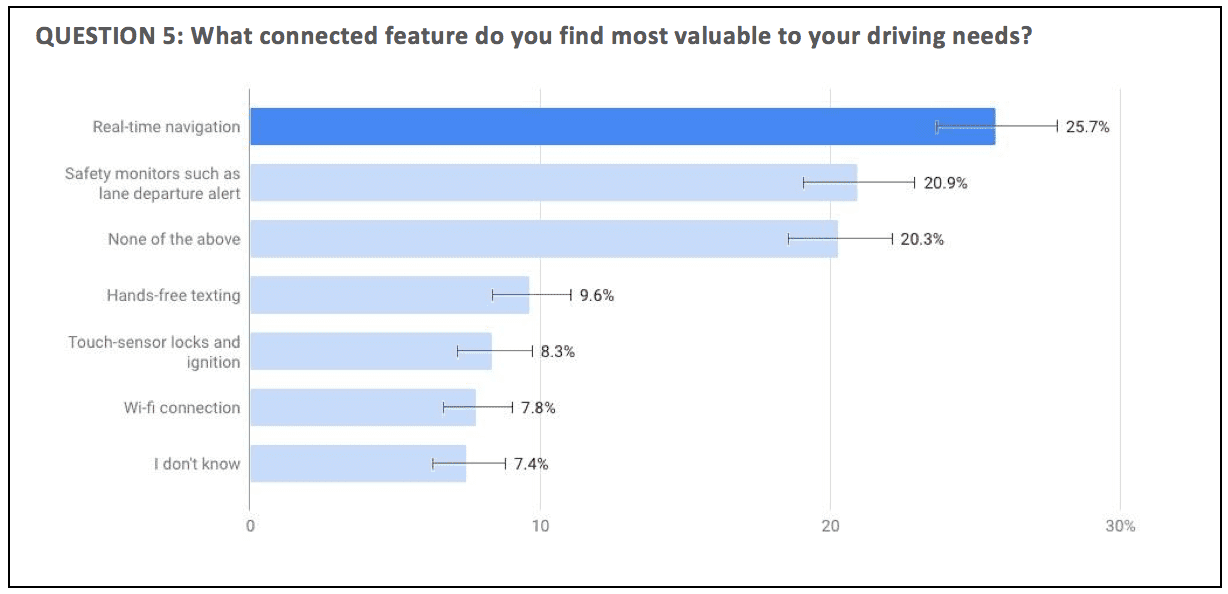

When it comes to connected car capabilities, safety and navigation features are the most trusted and valued features for U.S. drivers.

Half (49%) of U.S. drivers are most likely to rely on safety sensors — such as lane departure alerts — in a connected car; while one in three (35%) are most likely to rely on navigational driving prompts.

One in four drivers (25.7%) believe navigation is the most valuable connected feature for their driving needs; while 20 percent selected safety monitors as the most valuable connected feature.

Connected car drivers aren’t overly dependent on apps when they drive, but how the app performs impacts their driving experience

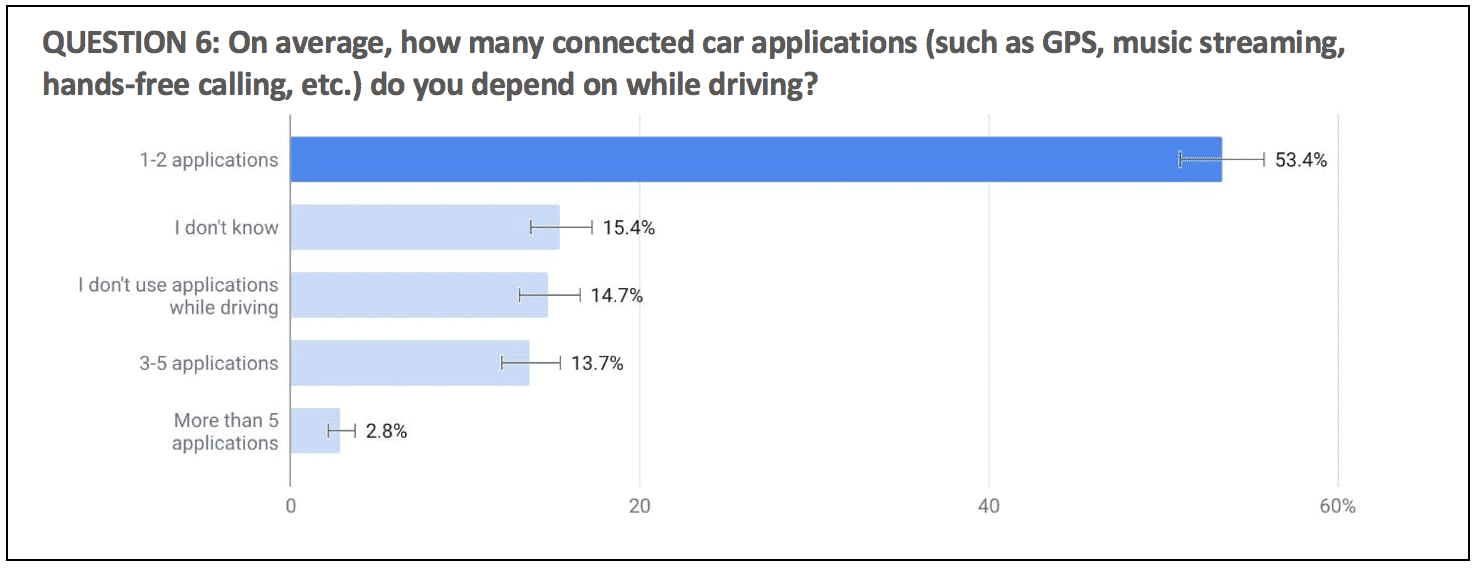

When asked how many applications connected car drivers depend on while driving, over 50 percent of respondents use one to two applications. Less than three percent noted using more than five.

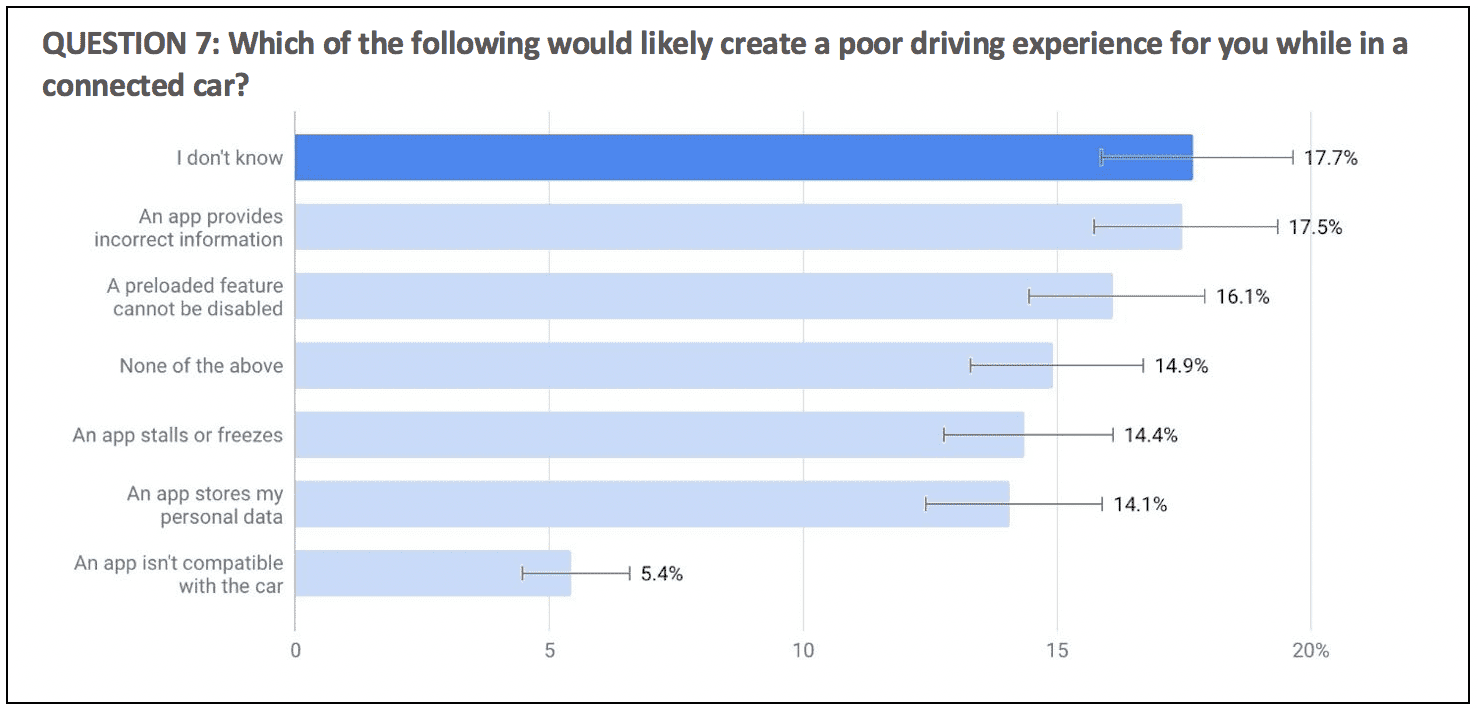

About 15% of U.S. drivers said that if an app they’re using froze or stalled while they were driving it would create a poor driving experience. Additionally, almost two in five (17.5%) become frustrated while driving if an app provides incorrect information.

This is another example highlighting the difference between improving the driving experience vs. completely taking over the experience.

Interestingly, most connected car drivers aren’t yet sure which connected experience would create the poorest driving experience for them. This could point to how existing connected technologies have been relatively successful in refining the driving experience, and to how drivers are used to relatively minor experience modifications.

Most consumers don’t know what happens to their data in a connected car

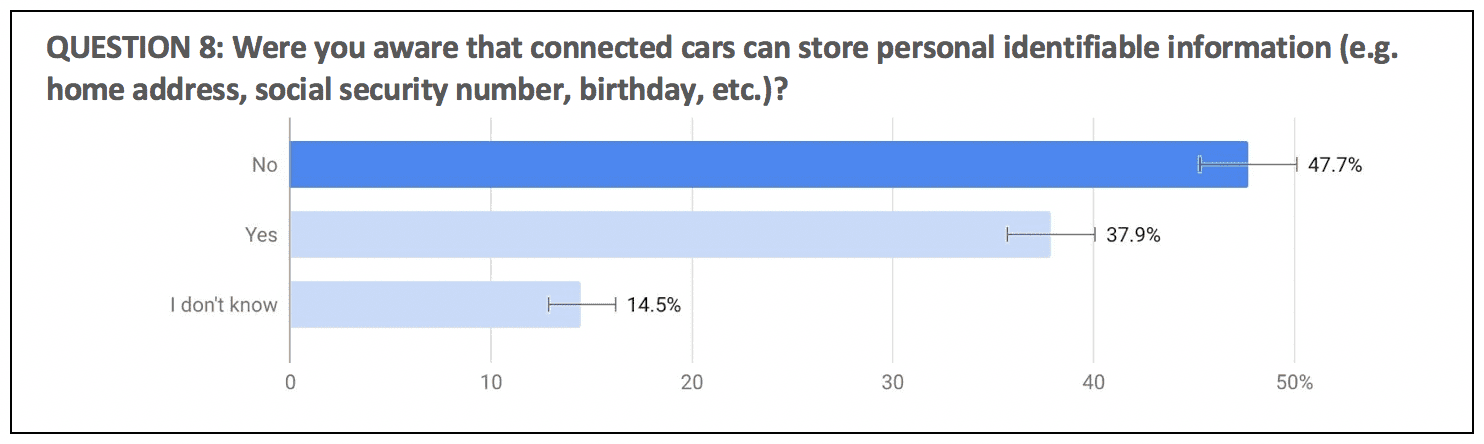

Almost half of U.S. consumers don’t know that connected cars could store their personal data, such as their home address, social security number, birthday, etc.

The responses here are worth thinking about in the context of discussions around data ethics and privacy. While consumers are increasingly aware of and sensitive to how social media and cell phone technologies are using their data, discussions around connected car data use are still in the nascent stage.

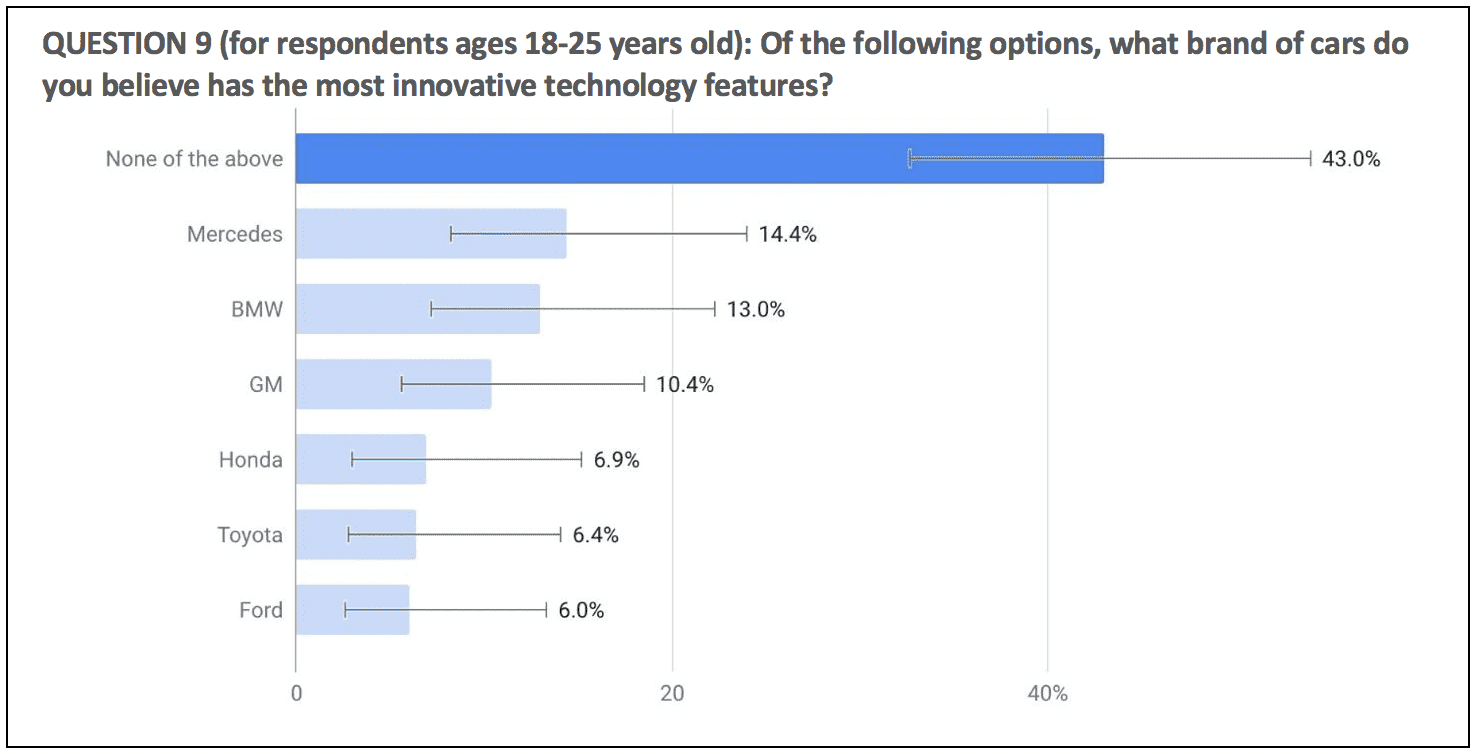

There is no clear leader among the top six car brands in the race to build innovative, technology-powered cars

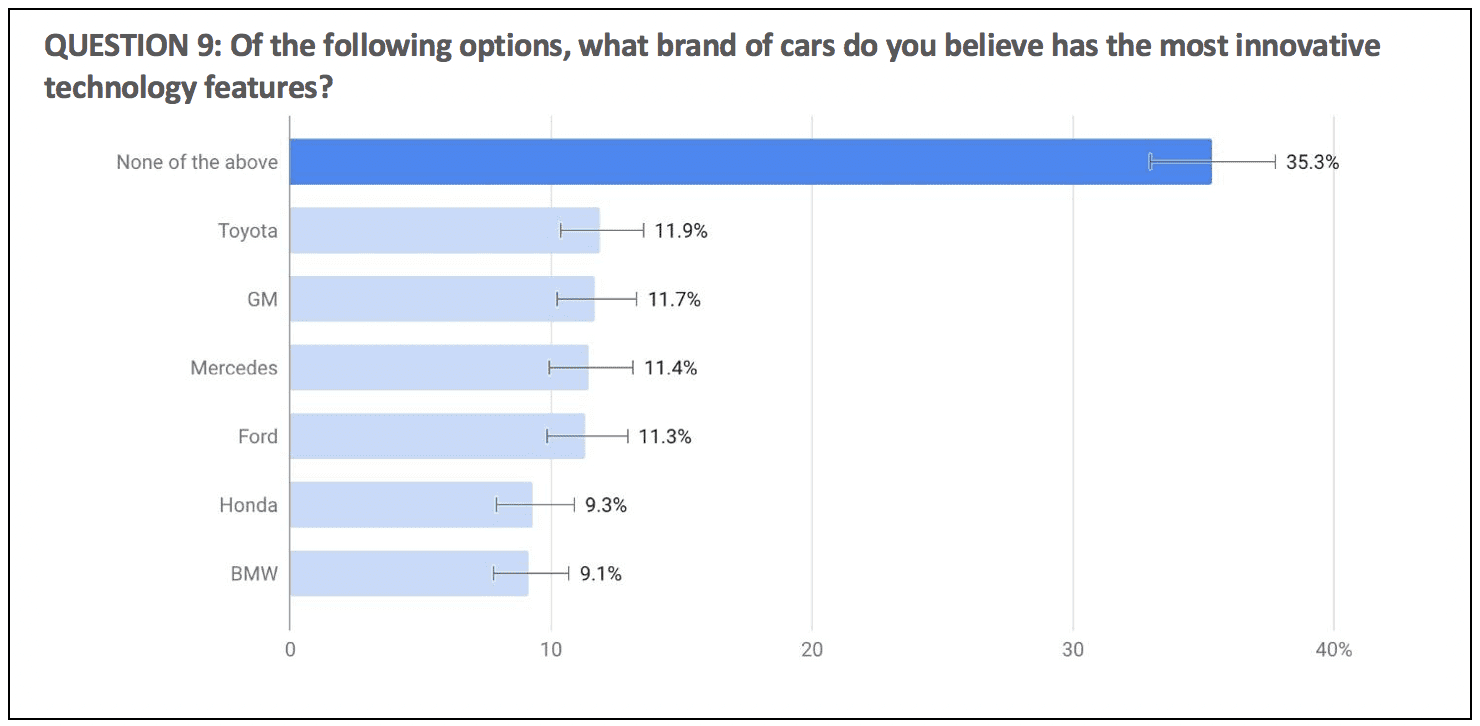

When given a choice between the top six car brands* — Ford, GM, Honda, Toyota, BMW, and Mercedes — one in three consumers didn’t consider any of these brands a leader in having the most innovative car technologies.

*Car brands were selected based on FY 2017 US sales according to Motor Intelligence Autodata. The top two brands from North America, Europe and Asia were selected for the purpose of this survey.

Among younger drivers (ages 18-25), however, two companies do stand out: Mercedes (14%) and BMW (13%). Still, the results here point to how “best-selling” isn’t necessarily viewed as the most innovative. It also points to how lesser-known brands are likely considered the most innovative, but how there may be purchasing barriers limiting consumer access.

Conclusion

For connected car drivers, new connected technologies have clearly improved their driving experience. But in the buzz of excitement around self-driving cars, it’s clear that consumers are more comfortable with minor modifications than full-on experiential takeovers.

Autonomous vehicle technologies are improving by the day. This survey points to how the limiting factor to their widespread adoption is not the pace of technological advancement but the trust of consumers.

See also: