Your challenge

Innovate and increase efficiency while managing risk and ensuring compliance.

Oh, and never suffer an outage.

With increasing regulatory and compliance requirements (MiFID, FX Global Code), new fintechs pushing the pace of innovation, and rising trading volumes and volatility pushing legacy systems to their breaking points, it is more important than ever to answer the following questions:

- How can you serve traders, quants, analysts – especially post-Covid – with disjointed services in your front, middle and back offices and that make it hard to establish secure, compliant connections between them?

- How can you maintain market share against fintechs when your team can’t innovate fast enough to deliver at the scale and speed you need?

- How do you deal with periods of volatility when there are massive swings in positions, and your legacy systems are at a breaking point?

The solution

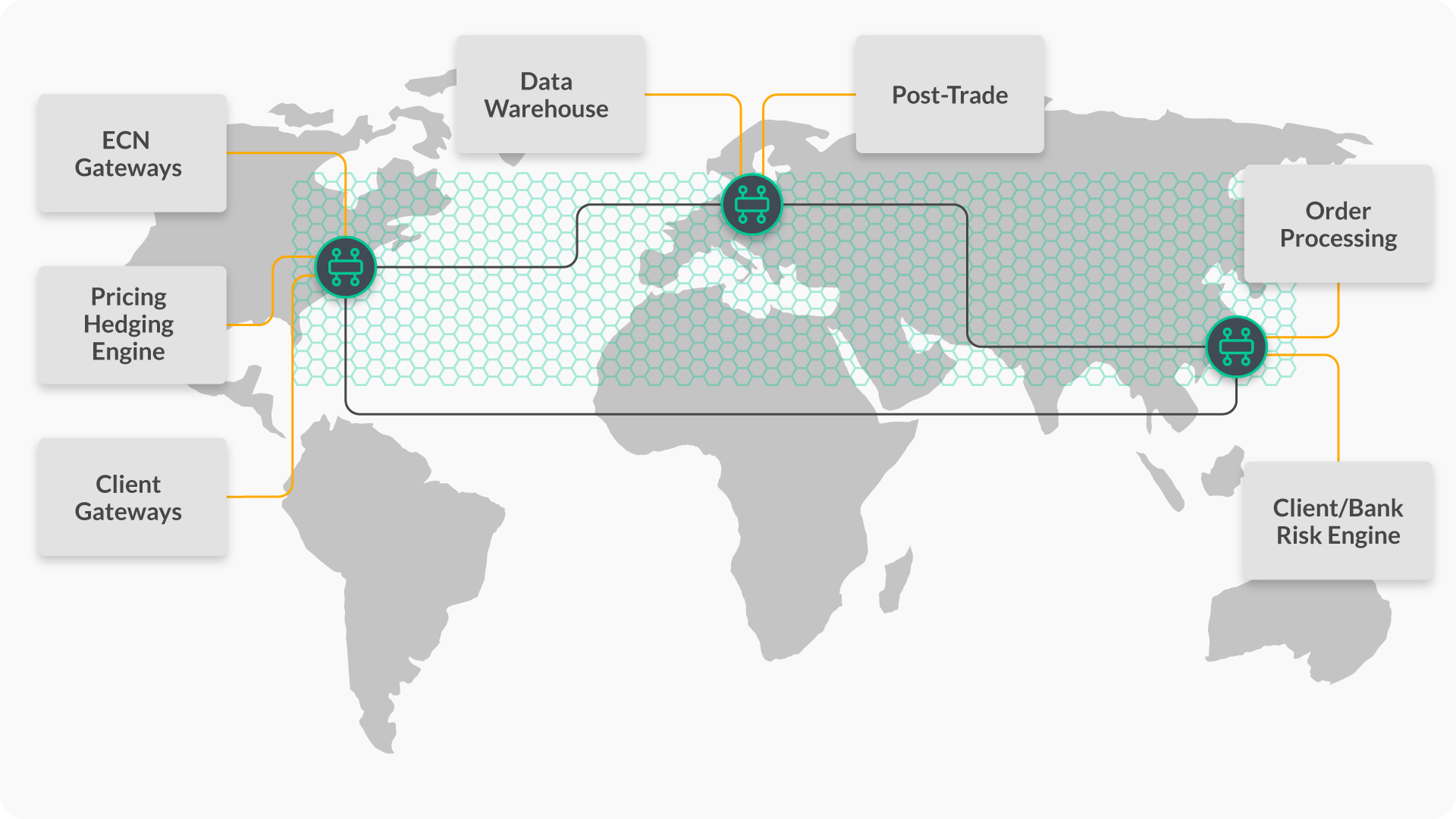

Link your web services or thick front-end apps, ECNs and post-trade systems with an event mesh.

The key to a successful FX line of business is coupling fast front-end with a back-end that executes trades at ECNs with high-liquidity.

An event mesh supports this by enabling real-time, event-driven communications between systems and services across environments and geographies.