Your challenge:

With increasing trade volumes and products, and critical data spread across silos, it can be difficult to find business insights and comply with financial regulations and audit obligations.

Post-trade systems don’t get much love. But investment banks and FIs now realize that legacy infrastructure will fail in high-volatility situations.

And new entrants are leveraging market volatility to create value for their customers.

Creating a system to propagate and analyze market and reference data is crucial to building innovative products, keeping operational costs low, flagging bad actors, and staying compliant. None of this is possible until you answer these questions:

- How will you democratize your data when it’s locked in silos and tied together with point-to-point connections that make it difficult to scale?

- How will you leverage advanced solutions from the cloud when your data sets are enormous and your on-prem systems are built for point-to-point connections?

- How will you streamline your single source of truth when there are multiple copies of the same data?

- And because adding compute capacity will not help slow systems on the edge, how will you handle days of volatility?

COVID-19 has resulted in unprecedented trading volumes and volatility, but even as we’ve climbed from 65 billion messages a day to over 118 billion, we’ve had no outages or degradations in performance in our critical market data and messaging applications. Our Solace messaging and eventing platform took the data increases in stride.”

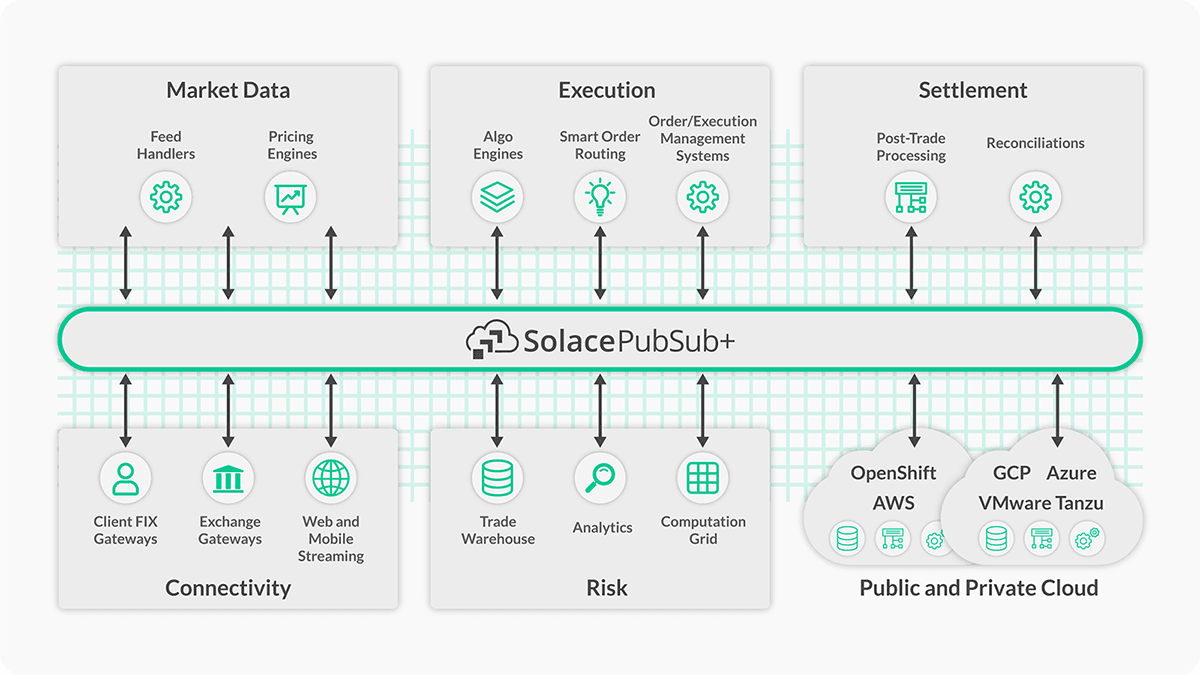

Used by 6 of the 10 world’s biggest investment banks and 3 of the top 6 FX trading banks, Solace meets the diverse data movement needs of banks, capital markets participants, and exchanges.

The solution:

Link your back and middle office systems with an event mesh to securely share key events between applications and efficiently use cloud resources for analytics and other specialized needs.

An event mesh helps you share a simple event, like placing a market trade, with multiple systems which can derive relevant outcomes and next steps.

Some use an event mesh to inform other metrics like the bond yield curve, while others use it to flag a transaction as “suspicious” so the front-end systems can continue focusing on incoming transactions.

An event mesh also taps into legacy systems to unlock organizational knowledge while ensuring that slower, batch-based systems are not pushed beyond their limits.