Your challenge

Modernize your market data system for greater efficiency and lower costs while improving both compliance and burst handling.

The increasing volatility of capital markets has exacerbated longstanding problems with the pricing models of market data providers, and the expenses associated with making market data available across your enterprise can dwarf the cost of acquiring it by a factor of 8*. Between that and the need for quants and risk managers to quickly back-test for investment strategies and compliance metrics, it’s imperative that buy-side and sell-side firms alike are able to answer these questions about how they receive market data:

- How do you ensure the trusted sources of data across your business don’t contain redundant or conflicting information?

- How can you maintain information security, regulatory compliance and the trustworthiness of data while using cloud resources to increase capacity?

- How can you reduce the cost of acquiring and maintaining market data?

The Solution

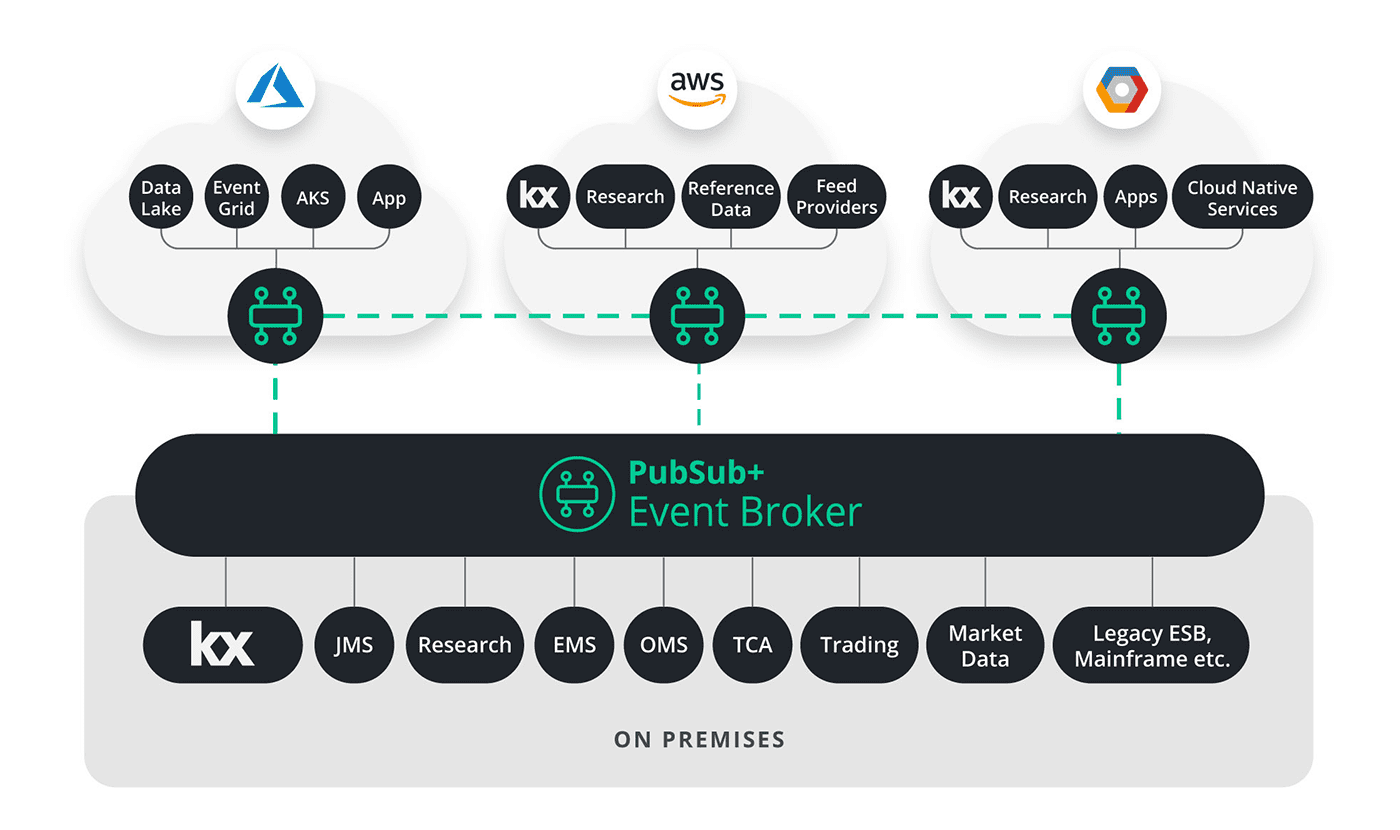

Solace makes it easy to efficiently route real-time market data between trusted data sources and other front- and back-office systems across on-premises and cloud environments.

The keys to a successful market data management strategy are reuse and reliability.

An event mesh gives you the means to work with virtually unlimited number of data sources over a wide variety of interfaces, including your trusty Excel spreadsheets and utilizing Webhooks.

Solace can help you link trusted sources of data across your ecosystem and enable your teams to innovate with cross-asset products, indices and back-testing capabilities.