Trusted by 40% of the Top 10 world banks including

Customer-centric, omnichannel retail banks are leveraging the power of EDA

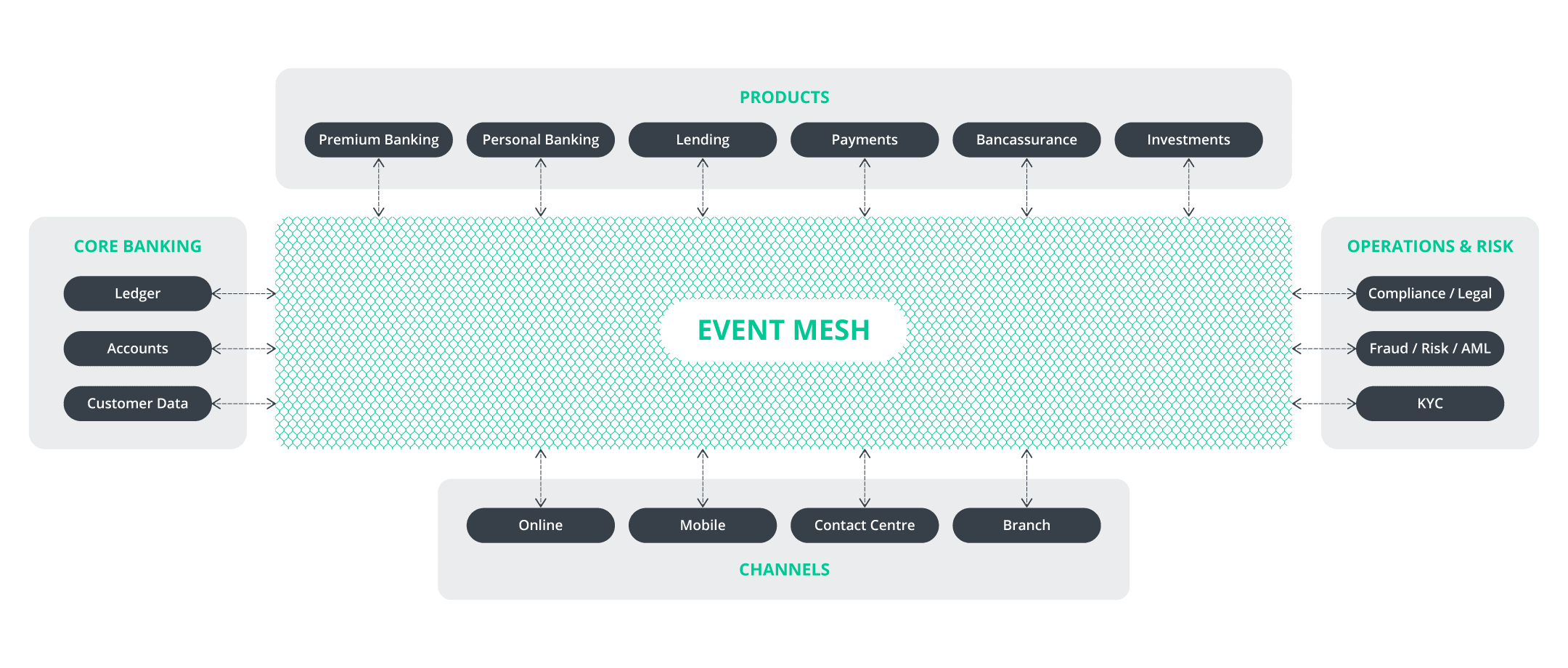

The solution: Link your back-end systems, web services and customer-facing channels with an event mesh.

The key to meeting the needs of digital banking is establishing a continuous flow of information that spans your entire business and reaches to and from your customers.

An event mesh does exactly that, enabling real-time, event-driven communications between systems and services across environments and geographies.

Enabling Modern Digital Retail Banking with Event-Driven Architecture

Learn how retail banks can benefit from EDA - event-driven architecture - and what you need to know about selecting a platform to support your EDA adoption.

We were looking for a system that offered guaranteed messaging, a dashboard to configure resources, and the means to secure data both at rest and in transit. We needed a way to migrate from one environment to another, support for hybrid cloud and Kubernetes, and someone with experience in the finance industry… all this was not possible with any vendor other than Solace.”