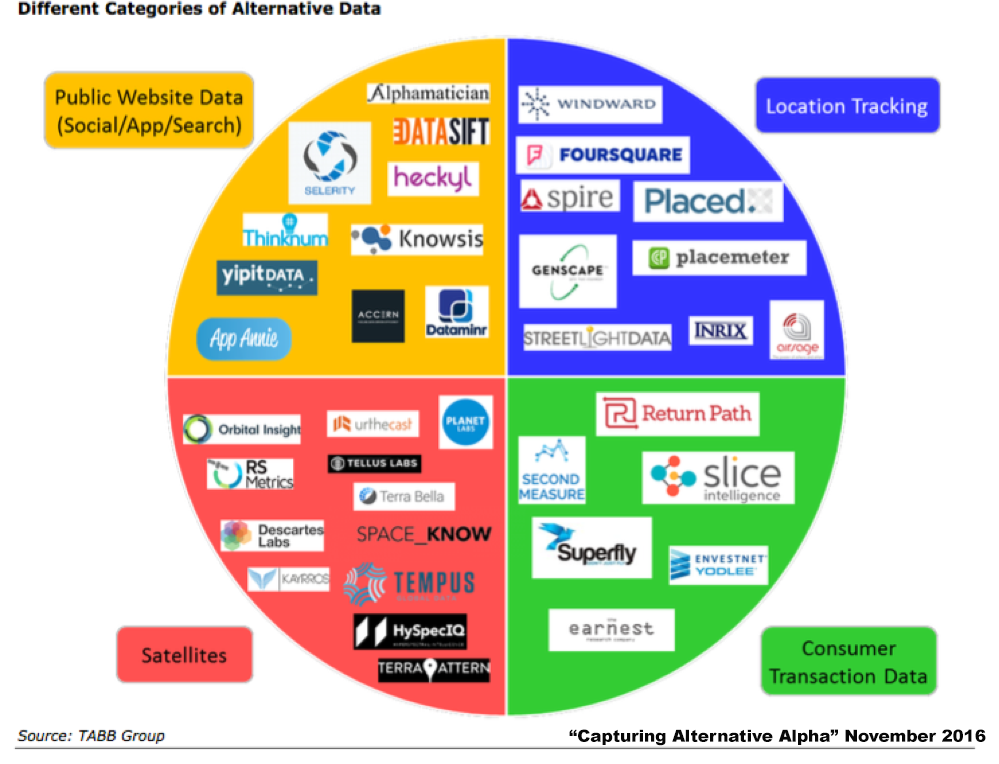

Our recent webinar on July 11th introduced attendees to how machine learning (ML) and artificial intelligence (AI) are changing the nature of financial technology, known these days as fintech. Our speakers, Terry Roche of Tabb Group and Keith McAuliffe of Solace dove into the impact these technologies are having on modern capital markets.

Together, Terry and Keith explained how AI has evolved from a backroom experiment to being a key part of significant “run the bank” programs like trade surveillance and sentiment analysis. Today the focus is on cost savings and compliance, but things are clearly moving towards revenue generation.

They then covered the emerging needs of new fintech, like hybrid clouds and microservices that all organizations are looking to as they respond to ever-changing infrastructure.

Solace

Solace