When you play Tetris, your success hinges on your ability to build a solid foundation into which you can fit whatever comes next. It’s easier said than done, of course, especially as the bricks start falling faster – one misplaced brick can quickly leave you with little margin for error, and even the need to blow the whole thing up and start over!

In the financial services industry, the bricks are the new tools it takes to stay ahead of ever-evolving customer preferences and competitive forces while satisfying new regulatory requirements and supporting increasingly volatile trading volumes.

How a Solid Technology Foundation Can Help You Adapt

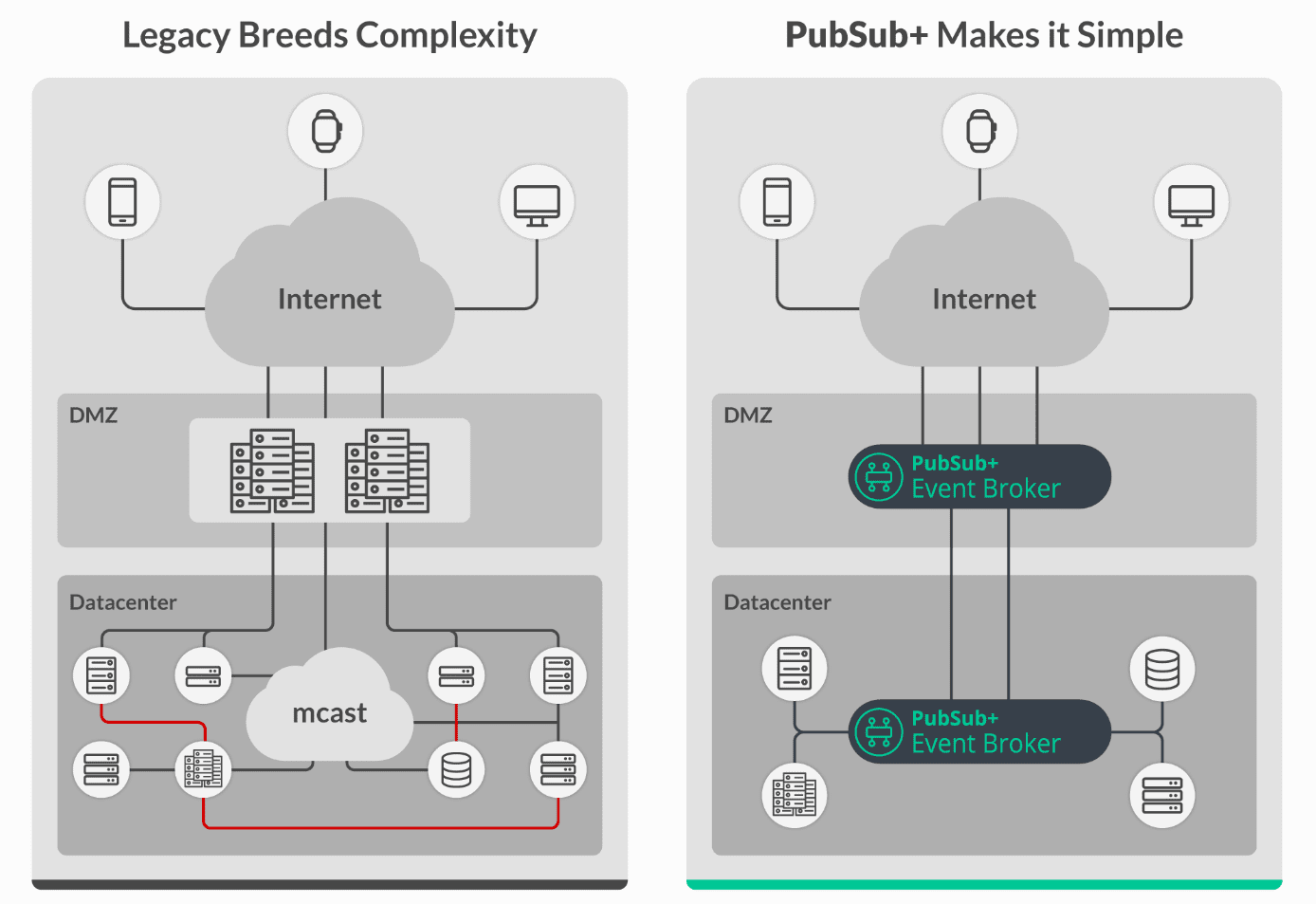

Technology investments made years or decades ago can hinder a company’s ability to respond and take advantage of changes and opportunities in the market. At some point, adding more servers doesn’t help. Disjointed services deployed in front-, middle-, and back-office struggle to connect with the hundreds of different data flows that serve traders, quants, analysts etc. The technology isn’t broken, but it’s inflexible and can be hard to integrate with modern systems, so you can’t adapt it fast enough to meet new demands or have an edge over the competition.

And if there’s one thing you can count on in capital markets, it’s constant change.

Big banks like Citi are innovating by developing ways to work with fintech companies, like through their marketplace for fintech apps or their API Developer Portal. Other fintech entities are focusing on the customer experience with AI, IoT devices, cloud technology, etc.

Whether your company is reacting to new competitors or aiming to extend a position of clear leadership and strength, you can gain an advantage over the competition by building (or transitioning to) a technological foundation that lets you quickly and easily change the way you do business, and that includes adding new tools to your belt.

Event Mesh = Agility

Application leaders across industries are adopting new technology called event mesh to help them build and deploy new services and experiences that leverage the institutional knowledge that they have built over the years by tying it to new cloud-native apps and microservices.

With an event mesh, old and new systems alike connect to a common platform that lets them send and receive messages without any overheads. This is achieved through topics. You can read more about the importance of topic hierarchy in our blog.

This means you can add a new tool or service to the mix by subscribing it to existing topics so it immediately gets information it needs without the publisher or any other subscribers even needing to know its there, let alone affecting their own ability to receive it.

Similarly, the new service can send information to the topic and all of the systems across your business can start receiving and hopefully benefitting from it.

This means you could, for example, run streaming analytics or AI/ML algorithms on customer behavior not just considering the purchase they just made, but patterns reaching back into their 10-year history with your bank. Or use a distributed ledger technology (DLT, like Blockchain)-based tool to enable secure, real-time peer-to-peer trades and transactions that are tied into your compliance and risk management systems.

In the next sections, I’ll provide a couple of examples.

Building a Single Dealer Platform a Better Way with an Event Mesh

The conventional way that Forex banks build single dealer platforms – where a web streaming product will be deployed on server farms at the network edge – involves some kind of bridging to connect with the message bus supporting the market data and pricing engines. Then, it might involve another product to take care of WAN bridging and storage to databases, and each layer and product has its own engineering, operations, and monitoring requirements to build out.

An event mesh that supports all of your favorite APIs, protocols and programming languages lets you link systems while letting them speak their own languages so you can ship products faster and can use reference data from across your organization, and provides a single monitoring and management experience so you can visualize, reuse and lifecycle manage all of your event streams and event-driven applications.

How an Event Mesh Improves Trading and Real-Time Data

Whether you’re dealing with an inter-bank transfer or a multi-million-dollar currency trade, the margin spread will depend on how you fulfil the trade. And that will depend on your enterprise architecture.

That’s why WAN efficiency is such a key part of making sure a trading platform is not overwhelmed when dealing with demands and can make a huge difference in how well an organization can distribute market data across its ecosystem and how they keep Position data intact across time zones.

Conventionally, an inter-continental WAN bears the load of querying and finding rates and inventory for a currency pair. This approach is slow and depends on the quality and occupancy of the WAN links. The time it takes to find the best rates and the right venue to execute the trade is directly linked to the volume of business you can take and the spread you can create for your business.

An event mesh gives you the ability to accept a request close to the client and execute near-instantly at the appropriate trading hub (say, the one with the highest liquidity). The speed and reliability of this system is crucial to not just winning more business, but also preserving current market share. The WAN links are still crucial, but not the primary determining element of the success of your forex trading business.

With this architectural layer connecting business units and business functions, a bank can easily update their yield curves in one part of the business and share widely to parts of the organization that could benefit from the information.

It also enables some of the largest forex companies in the world to service their customers better and maximize their spread while increasing the overall efficiency by being able to cache currency pairs and other relevant data on the edge, closest to ECNs.

How an Event Mesh Helps with Regulatory Compliance

Remember, the speed with which you can deploy new services is throttled by the need to follow regulations. The compliance spectrum is wide, and penalties and loss of market reputation can be catastrophic. While forex is largely self-regulated, banks do feel an obligation to comply with guidelines from MAR, MIFID II and now the Global FX Code of Conduct. Large financial institutions have already started to lay the groundwork for this and it’s only a matter of time before the guidelines becomes regulation.

From a compliance perspective, an event mesh provides a unified platform that can support a variety of communications patterns (peer-to-peer and multi-dealer) and gives the ability to monitor/report all connections through a single pane of glass.

With the power of dynamic topic routing and event discovery, you can find, and stream data as required by regulation. For instance, if a certain currency-pair trade can only be requested and executed in a specific region, the dynamic routing capability gives you the ability to build this into your systems.

Conclusion…

Just like Tetris blocks, the new technologies and tools won’t stop coming at you. Some of them are a pain to deal with, some of them fit nicely almost anywhere. Your job is to build a foundation that lets you take advantage of whatever pieces come your way.

Technology is getting more complex, so simplifying what you have today and laying the groundwork to support the technology of tomorrow is the best chance you have at succeeding. Simplification through a dynamic architectural layer for distributing data among applications, cloud services and devices will prepare you to handle complexities that can come with advancing technology.

Above all, companies in the financial industry require high performance and a stable tech stack. An event mesh can give you the agility and options you need to solve your current challenges and the ones coming up.

Gaurav Suman

Gaurav Suman